Landscaping businesses operate in a dynamic environment where labor is often the single largest expense. Whether you manage a small lawn care operation or a larger contracting firm, underestimating labor costs can undermine profitability and stunt long-term growth. While focusing on hourly wages is important, many additional factors—taxes, benefits, insurance, and non-productive hours—significantly affect your margins.

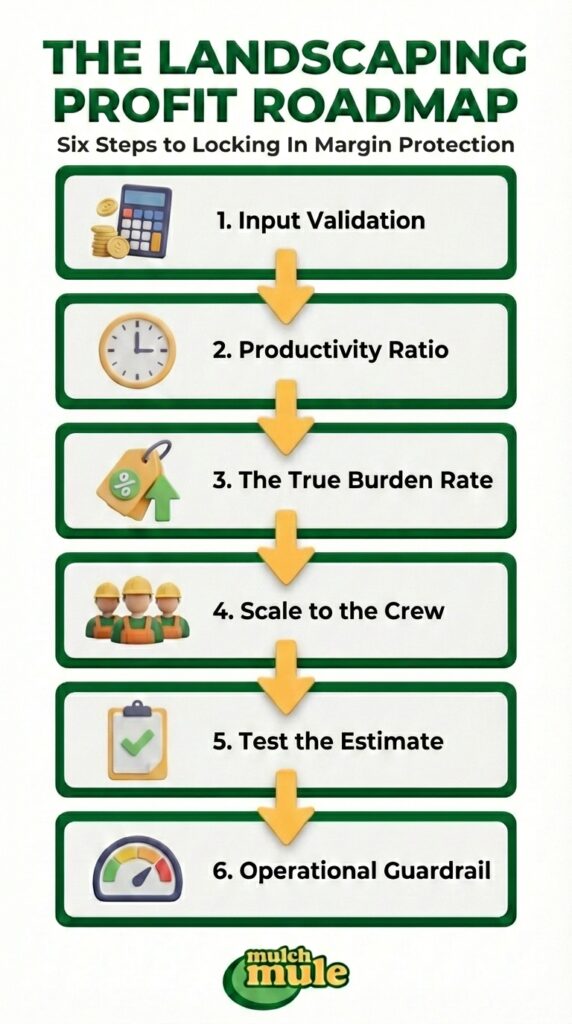

This article walks you through the concept of “fully burdened labor cost” and explains why precise calculations lead to improved pricing strategies, stronger profit margins, and operational efficiency. You will learn key steps, explore common mistakes, get answers to frequently asked questions, and understand how small changes in your labor costing approach can produce big results.

Understanding the Importance of Accurate Labor Cost Calculations

Landscaping is a multi-billion-dollar market with strong demand for maintenance and construction services. Accurate labor cost calculations are vital in such a competitive space. By fully grasping every cost component, you can:

- Quote competitively, ensuring your pricing covers all labor expenses.

- Adapt to changing cost environments, adjusting for fluctuations in wages or insurance premiums without eroding profit.

- Optimize crew utilization by identifying operational inefficiencies, such as excessive downtime.

Beyond enabling precise project bids, understanding fully burdened labor cost helps you highlight areas for operational improvements, from scheduling to equipment usage. In other words, an accurate labor cost framework aligns with both short-term profitability and strategic, long-term planning for your landscaping business.

Why Wage Rate Alone Fails to Capture True Labor Cost

Many landscaping businesses underbid jobs by relying solely on hourly wage rates. In reality, multiple “hidden” costs should factor into your labor expenses, including:

- Payroll taxes: Social Security, Medicare, state, and federal unemployment taxes generally add 7.5%–10% to wages.

- Benefits: Health insurance, bonuses, and retirement plans can significantly increase total costs.

- Insurance: Workers’ compensation and liability insurance protect your business but introduce notable expenses.

- Paid Time Off (PTO): Vacation days, sick leave, and holidays must be accounted for in hourly labor cost calculations.

- Industry Labor Challenges: Experts address major landscaping labor challenges that increase your overall workforce costs.

Because these expenses can easily boost an $18/hour wage to $25–$30/hour in total costs, ignoring them can erode profitability. When those hidden costs are overlooked project after project, the margin impact becomes even more severe.

Step 1: Gathering Essential Data

A thorough, up-front accounting of labor-related costs is indispensable. Make sure you capture:

- Wages: Base pay, including overtime and performance bonuses.

- Payroll Taxes: State and federal tax obligations tied to your payroll (refer to step-by-step payroll tax calculations for detailed guidance).

- Insurance and Liability: Workers’ compensation and general liability premiums.

- Benefits: Any company contributions to health care, retirement plans, or similar programs.

- Paid but Non-Productive Time: This includes PTO, training sessions, and travel.

- Reliable Records: Make use of payroll reports and timesheets to ensure that all expenses are fully captured and accounted for.

Having accurate data is not just about compliance; it sets the stage for better decisions on staffing, scheduling, and equipment utilization.

Step 2: Differentiating Paid Hours from Productive Hours

Although a full-time landscape employee may be paid for 2,080 hours a year (40 hours/week × 52 weeks), many of those hours are non-billable. Common non-productive activities include:

- Drive time between job sites.

- Mandatory training sessions.

- Administrative tasks (e.g., loading or cleaning equipment).

- Paid leave for vacations or sick days.

By distinguishing non-productive time from productive hours, you calculate a more realistic cost basis per billable hour. For example, if a team member is paid for 2,080 hours but only 1,700 are truly productive, the hourly labor cost must reflect that ratio to avoid underpricing. Reviewing broader labor data—such as BLS data on landscaping and groundskeeping workers—can also give context for typical hours and pay rates in the industry.

Step 3: Calculating Fully Burdened Hourly Labor Cost

After collecting all pertinent data, two popular methods are used to calculate your fully burdened labor cost per hour.

Method A: Line-Item Approach

- Base Wage: Start with the employee’s hourly wage.

- Payroll Taxes: Add taxes to the hourly rate (e.g., an extra $1.50–$2.00/hour).

- Insurance: Include workers’ compensation and liability coverage costs (e.g., another $1.50/hour).

- Benefits: Add costs for benefits such as retirement and health coverage (e.g., +$1/hour).

- PTO and Non-Productive Hours: Allocate a portion of your annual expenses associated with paid but non-billable time (e.g., +$1.50/hour).

Example: An $18/hr wage might yield approximately $26/hr once all items are accounted for. This thorough, additive method ensures you see exactly how each cost category factors in.

Method B: Multiplier Approach

A quicker alternative uses multipliers:

- Determine a multiplier for taxes, benefits, and insurance (for example, 1.30–1.40).

- Add a further multiplier for non-productive time (maybe 1.10–1.20).

Example:

- Base Wage: $20/hour.

- Estimated Combined Multiplier for taxes, benefits, and insurance: 1.35.

- Additional Non-Productive Time Multiplier: 1.15.

Calculation:

$20 × 1.35 × 1.15 = $31.05/hour

While faster than a line-item approach, the multiplier method should be revisited periodically to stay accurate as costs change.

Step 4: Converting Individual Labor Costs into Crew Rates

Landscaping projects are typically handled by teams. Converting individual costs into a single “crew rate” ensures you estimate labor expenses at the project level:

- Sum Individual Costs: Add each crew member’s fully burdened hourly rate.

- Adjust for Supervisory Roles: If a foreman, project manager, or crew leader oversees multiple crews, allocate their cost proportionally.

- Factor in Overhead Activities: Even if not all tasks are direct landscaping labor, distribute drive time and other overhead equitably across all jobs.

For example, a three-person crew might have these individual loaded costs:

- Crew Leader: $30/hour

- Technician 1: $26/hour

- Technician 2: $24/hour

The total crew rate is $80/hour. This figure becomes the basis for bids and invoices.

Step 5: Turning Crew Costs into Realistic Job Costing

Accurate job pricing starts with multiplying your crew rate by the anticipated number of labor hours. Suppose a 30-hour project is charged at $80/hour for labor, totaling $2,400. After the job, compare:

- Estimated Hours vs. Actual Hours: If you logged 35 hours instead of 30, determine why. Additional drive time or time lost to weather or inefficiencies can offer lessons for future bids.

- Overruns and Surprises: Labor overruns—including overtime—quickly drive up costs.

Refining your pricing with real-world data collected from each project helps prevent consistent underbidding and ensures more predictable margins.

Step 6 — Use the Number to Protect Margin

Now that you have a true fully burdened labor rate, the goal is simple: use it as an operating guardrail so small inefficiencies don’t quietly eat your margin.

Labor as % of revenue: what you’re really monitoring

Once you’ve calculated fully burdened labor, the most practical way to use it day-to-day is tracking labor as a % of revenue.

Labor % = Fully burdened labor dollars ÷ Revenue

This metric helps you spot issues that quietly erode margin—like excess travel time, too much downtime, over-crewing, or jobs that routinely take longer than expected. Track it per job/route day (fast fixes) and monthly (bigger trends).

Break-even reality check (quick math)

Use your crew’s fully burdened rate for a quick “are we safe?” check.

Example:

- Crew (fully burdened): $80/hr

- Hourly revenue after direct materials/subs: $120/hr

- Left for overhead and profit: $120 − $80 = $40/hr

If that leftover number is thin, you don’t need a pricing overhaul—you need to reduce hours, tighten production, or adjust crew mix.

What to do when labor is too high

If labor % is trending high, focus on controllables:

- Verify your inputs: productive hours, drive time, PTO, insurance/tax assumptions.

- Tighten production: better routing, standardized load-out, clearer job start/finish expectations.

- Fix “hour leaks”: travel between stops, material handling time, rework/callbacks.

- Close the loop: compare estimated vs. actual hours on every job and address repeat offenders.

- Use equipment/workflow to save hours: every hour saved equals your fully burdened crew cost in margin protection.

Treat your fully burdened labor rate like a baseline—then manage the hours, crew structure, and process around it to protect margin consistently.

Common Mistakes to Avoid When Calculating Fully Burdened Labor Costs

In the rush of daily operations, it is easy to overlook elements that lead to an incomplete or misleading picture of your labor costs. Here is a quick checklist of common pitfalls:

- Ignoring Non-Productive Hours: Forgetting paid downtime, travel, or administrative tasks leads to underestimating actual costs per productive hour.

- Omitting Fringe Benefits: Health care premiums, retirement contributions, and bonuses can collectively push labor costs much higher than base wage alone.

- Overreliance on Simple Averages: Companies with employees at varying skill and pay grades often use a single average wage. This one-size-fits-all approach can distort your projections.

- Neglecting Frequent Updates: Taxes, insurance rates, and minimum wage laws can change. Failing to revise your burdened rate routinely risks chronic underpricing.

- Measuring by Wage Rate Only: Setting pricing based solely on base wages ignores the overhead elements that directly impact your bottom line.

By actively avoiding these typical mistakes, you can maintain a more accurate, transparent view of your labor costs.

Next Steps to Optimize Your Landscaping Business

Calculating fully burdened labor cost is only the beginning—and the real payoff comes from using it as a simple feedback loop to reduce wasted time and protect margin. Once you have a reliable number, apply it consistently:

- Review labor weekly: Monitor labor as a % of revenue and estimated vs. actual hours so small overages don’t become the norm.

- Track time with enough detail to be useful: Use simple time tracking (start/stop times and basic job codes) to pinpoint where non-productive hours—drive time, load-out, downtime—are creeping in.

- Tighten field execution: Standardize routing, load-out, and job closeout expectations to reduce repeat “hour leaks” and avoid callbacks.

- Identify repeat offenders: Flag properties, service packages, or install types that consistently run long and adjust crew mix, scheduling assumptions, or scope standards.

- Target high-impact efficiency upgrades: Prioritize workflow and exploring equipment improvements, such as the Mulch Mule trailer, that reduce heavy material handling, cut injury risk, and shrink labor-hours—because every hour saved protects margin at your fully burdened rate.

FAQ: Fully Burdened Labor Cost in Landscaping

What exactly is “fully burdened labor cost”?

Fully burdened labor cost is the comprehensive hourly cost of employing a worker. It includes wages, payroll taxes, benefits, insurance, paid time off, and any other expense directly linked to that employee’s labor. In landscaping, this ensures project bids and crew rates reflect the true cost of labor, preventing underbidding and eroding margins.

How often should I update my calculations?

Generally, businesses should revisit and adjust their calculations at least once or twice a year. If significant changes occur, such as a spike in insurance premiums or new employee benefits, recalculate immediately to keep estimates current and accurate.

Why is tracking non-billable time so important?

Non-billable (or non-productive) time—such as drive time, breaks, or staff meetings—contributes to overall labor costs even though it doesn’t generate revenue. If you ignore non-billable hours, you understate the true cost per productive hour, which often leads to underpricing.

How can modern equipment help me reduce labor costs?

High-efficiency equipment, like material handling equipment, can automate or expedite otherwise labor-intensive tasks. With smart investments that streamline loading, unloading, or spreading materials, your crews can accomplish more in fewer hours, effectively lowering your cost per project.

Can understanding fully burdened labor costs help improve employee morale?

Yes. Employees benefit when a company accurately budgets for labor because fewer projects run over schedule and last-minute overtime is reduced. This typically lowers the risk of burnout, helps maintain safer working conditions, and may allow your team to take on more rewarding, higher-skilled tasks.

Turn Your Labor Number Into Real Profit

Accurate, fully burdened labor cost calculations help you avoid common pricing pitfalls in landscaping. By recognizing all relevant factors—from payroll taxes and insurance premiums to paid time off and real-world productivity—you set the stage for more reliable project bids and smoother day-to-day operations. Once you have this framework in place, seek out ways to maximize efficiency: repurposing manpower, investing in modern solutions, and refining job costs.

If you are ready to secure your profit margins and streamline your landscaping operations, contact Mulch Mule for innovative, efficiency-enhancing solutions. By integrating precise labor cost data with advanced material handling equipment, your business can capture greater value, improve safety, and consistently deliver quality results for clients.